What now for Planners?

A combination of reduced fertility and the effects of COVID-19 have thrown a spanner into population numbers and planning

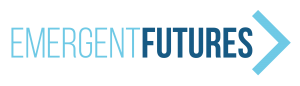

In the Australian budget release last week was the following graph:

Source: Budget papers

Apart from the budget numbers these changes are likely to have a huge impact on planning for infrastructure and housing over the next decade. Overlaid on these numbers are the possibilities for increased work from home arrangements altering the numbers on a council by council basis.

The reduced population forecasts are based on 3 factors:

1/ Reduced fertility

Analysis compiled by respected Australian National University demographer Peter McDonald, in work for the government’s Centre for Population, forecasts the fertility rate to drop to 1.59 next year and rise to 1.69 by 2024 before resuming a downward trend to 1.62 by the end of the decade.

Professor McDonald estimates the difference between the 2019-20 budget and his forecast equates to 56,000 fewer babies every year from 2019 to 2024.

This has impacts on the total population but also planning for schools and other services. If these numbers are correct this alone means 280,000 less children in school in Australia from 2029 onwards.

2/ Reduced migration

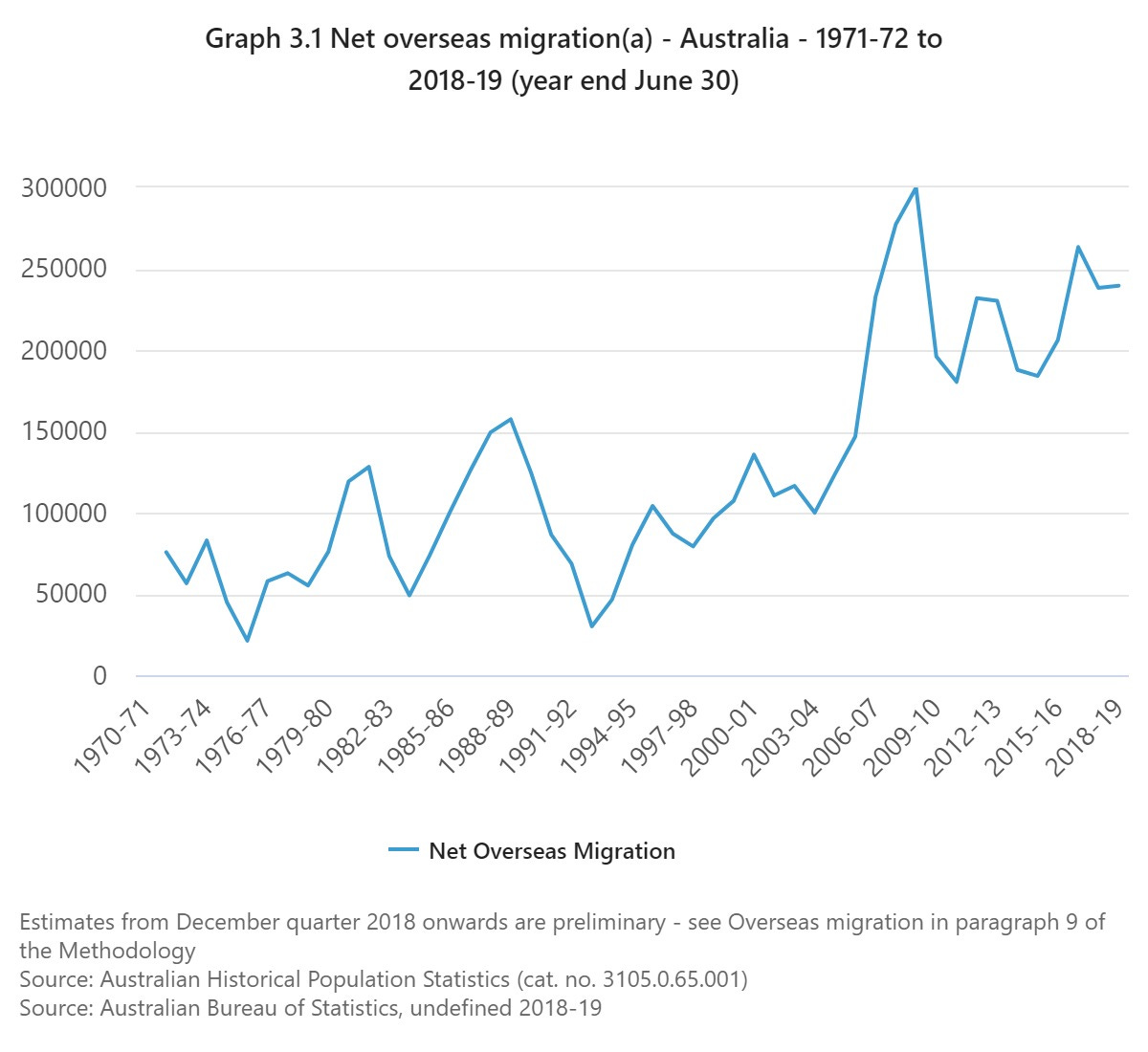

Net migration figures have been a big driver of population growth over the last decade. As the next graph shows there was a step change in net migration in Australia that was sustained for over a decade.

In the ten years to the 2005-06 year the average was 110,320 per year. Since that period the average has been 228,302. That is an extra 1.53 million people over 13 years compared to the previous average.

The budget papers estimate that net migration in 2020-21 will be negative 72,000 and in 2021-22 it will be negative 22,000 people. That means approximately 500,000 less people in Australia than previously estimated by the end of the 2021-22 financial year.

Added to the fertility forecasts that means 625,000 less people in total. Even if net migration figure rebound to the previous levels that means 737,000 less people in Australia than previously forecast for 2024.

3/ A reduced population base

Obviously less people due to the factors above means less population growth overall as we will be growing from a lower base.

Beyond this we then need to look at the work from home phenomenon. The pandemic has acted as an accelerant of this trend with many people being forced to work from home for the first time. Over the last few months I have done work for several clients looking at what this might mean. While there are considerable variations in the scenarios I have been involved in creating I believe there are several key points worth considering:

- Lots of people have been forced to work from home in difficult circumstances. They have had children home from school and have been forced into rapid change. Their experience can only get better.

- Face to face interaction is still going to be very important. How much of that is required is one of the key uncertainties. My view is that of the people that can work from home a significant number will work from home in the future 3-7 days a fortnight.

- The change may be slower than some people think. One of the key drivers is the cost of office space. Anecdotally a number of large businesses that have had renewals coming up for office space in the Melbourne CBD have delayed any extensions, waiting to see how things will play out. Many others have long term leases and may not push harder on work from home arrangements until those leases are up for renegotiation.

The key questions for planners are:

- How many people will end up working significant amounts of time at home?

- What does that mean for the desirability of various locations in the major cities and major regional centres?

- What do the changes mean for traffic flows and demand for other services. If 20% of residents in a particular suburb are working from home that changes traffic demand out of the area considerably but increases daytime demand for other services like cafes.

This will play out differently across different suburbs and regions but one scenario I think is highly plausible is that there is significant migration to the regional cities over the next decade. If a person is currently travelling 30 minutes each way every day to go to work then are they prepared to travel 90 minutes each way to go to work 3 days a fortnight? In total it is less travel time and if they can buy a property for 60% of the price of one in a major city it puts much less mortgage stress on their family. If this comes true then combination of reduced population growth plus migration to regional cities will fundamentally alter the growth paths of the major cities. It will be fascinating to see what happens.